Due Date Extended beyond May 2021 by Income Tax (CBDT)

In light of the severe pandemic and rise in Covid-19 instances, the CBDT -Income Tax Department has issued circular in the exercise of its power under section 119 of the Income-tax Act, 1961 (hereinafter referred to as "the Act"), w.r.t. Extension of time limits of certain compliances to give relief to taxpayers: (circular No. 09/2021, (F. NO.225/49/2021-ITA-1I dated 20.05.2021))

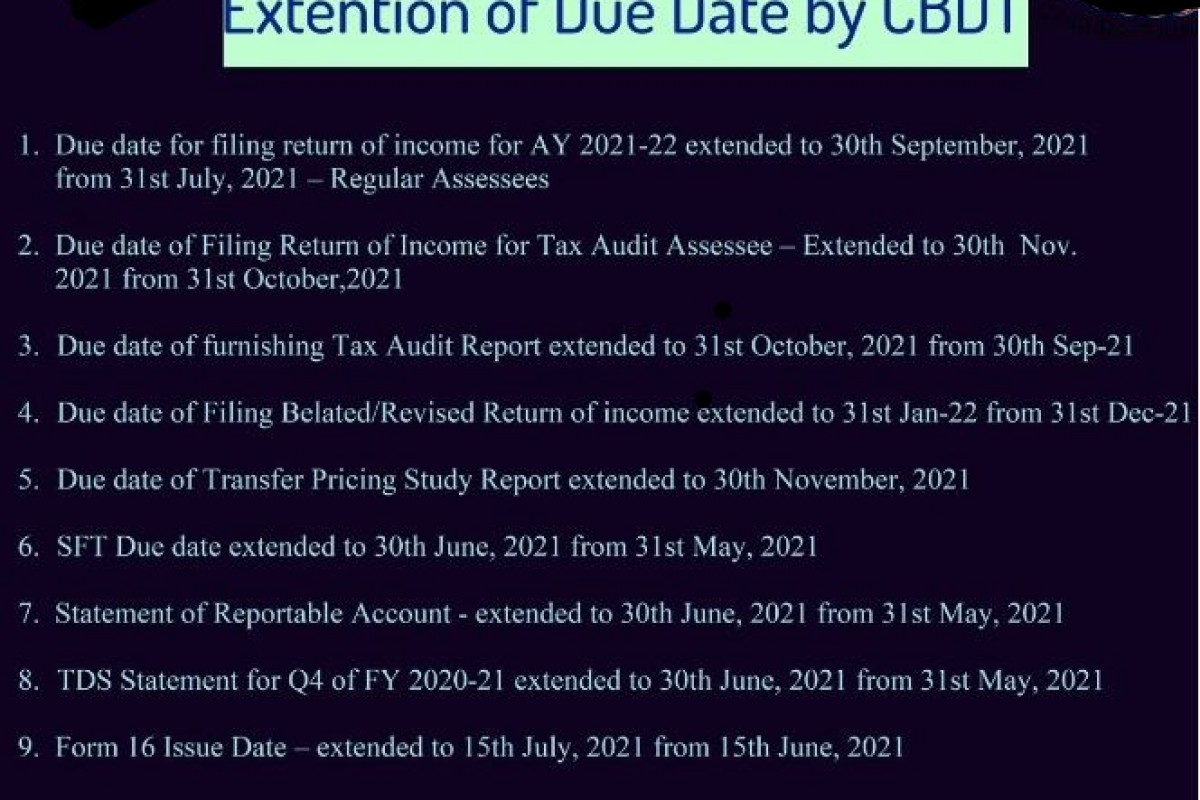

Extension Table

|

Sr No |

Nature of Extension |

New Due Dates |

Original due date |

|

1 |

Income Tax Returns - Normal assessee without audits – FY 2021 |

30.09.2021 |

31.07.2021 |

|

2 |

Filing of Audit Reports viz. Tax Audit Reports, Form 67 etc. – FY 2021 |

31.10.2021 |

30.09.2021 |

|

3 |

Issue of TDS certificates in Form 16 for the Financial Year 2020- 21 |

15.07.2021 |

15.06.2021 |

|

4 |

TDS/TCS Book adjustment statement in Form 24G for the month of May 2021 |

30.06.2021 |

15.06.2021 |

|

5 |

Statement of Income paid or credited by an investment fund to its unit's holder in Form 64D for FY 2021 |

30.06.2021 |

15.06.2021 |

|

6 |

Statement of Deduction of Tax in the case of a superannuation fund for FY 2021 |

30.06.2021 |

31.05.2021 |

|

7 |

Belated Returns and Revised Returns |

31.01.2022 |

31.12.2021 |

|

8 |

Statement of Reportable Account under Rule 114G |

30.06.2021 |

31.05.2021 |

|

9 |

Assessee required to furnish return u/s 92E in respect of international Transactions |

31.12.2021 |

30.11.2021 |

|

10 |

Statement of Tax deduction at source for the quarter ending 3151 March 2021 |

30.06.2021 |

31.05.2021 |

|

11 |

Corporate assessee or Firm covered whose accounts required to be audited or Partner of Firm whose accounts are required to be audited or any assessee other than Corporate and Firm whose accounts are required to be audited |

30.11.2021 |

31.10.2021 |

|

12 |

Due date of Furnishing Report from Accountant in respect of International Transactions covered u/s 92E |

30.11.2021 |

31.10.2021 |

|

13 |

Statement of Financial Transact ions u/s 285BA (SFT) |

30.06.2021 |

31.05.2021 |

|

14

|

Statement of Income paid or credited by an investment fund to its unit's holder in Form 64C for FY 2021 |

15.07.2021 |

30.06.2021 |

Kindly Note that: Note: all above extensions is planned in view of New ITD portal to be launched from June 7,,2021.

- Clarifications by CBDT:

1. Non-applicability: In cases where the amount of tax on the total income as reduced by the amount stated in paragraphs I to (vi) of sub-section (1) of that section above 1 lakh rupees, the extension of the dates referred to in clauses (1), (9), and (11) above shall not apply to Explanation 1 to section 234A of the Act.

2. For the objectives of Clarification 1, the tax paid under section 140A of the Act within the due period (without extension under this Circular) specified in that Act shall be deemed to constitute the advance tax in the case of an individual resident in India referred to in sub-section (2) of section 207 of the Act.

- Source: Click Here

CS Lalit Rajput,

Last updated 4 years ago

Comments

Login to Post Your Comment.

Categories

- Company Registration (14)

- Income Tax Return (5)

- Business set up in India (3)

- BUSINESS PROCESS RE-ENGINEERING FOR OPERATIONAL EFFICIENCIES (3)

- MSME Registration (2)

- Business Startup Consultancy (2)

- ISO Registration (1)

- GST Return (1)

- FSSAI Registration (1)

- GST Consulting (1)

- Company Annual Filing (1)

- Company Secretarial (1)

- E-commerce start up Consulting (1)

- One Person Company (1)

- Business Analysis (1)

- TDS Consulting (1)

- FEMA Compliance (1)

- ROC Filing (1)

- Business Valuation (1)

- FDI Advisory (1)

- BUSINESS CONSULTANCY & TRANSFORMATION OUTSOURCING (1)

- Diversification Strategy (1)

- Growth Strategy (1)

- LLP Registration (1)

- FINANCIAL STRUCTURING AND RESTRUCTURING SERVICES (1)

- GST AUDIT, RETURN & ITS PROCEDURES (1)

- AMALGAMATION SERVICES (1)

- GST AUDIT (1)